BitMine Immersion Technologies has added nearly $70 million worth of Ethereum to its holdings, pushing the company’s ETH stash to a value near $8.66 billion.

Related Reading

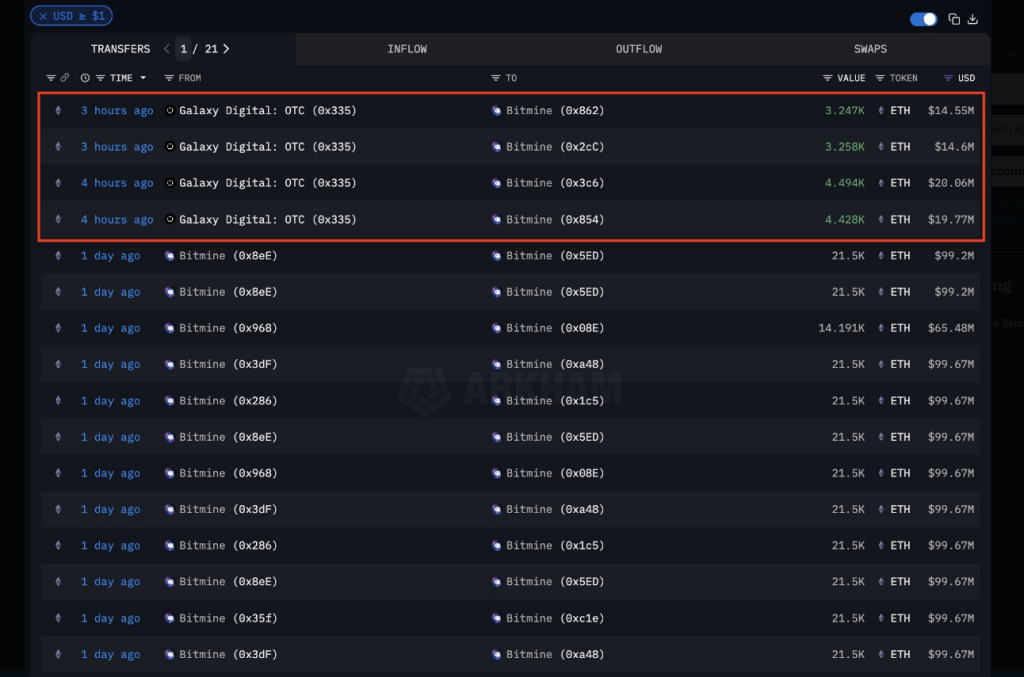

Based on reports, the purchases were made through Galaxy Digital’s over-the-counter desk and arrived in several chunks rather than a single block.

Purchase Broken Into Four Tranches

The recent buys were split into four settlements: 3,247 ETH ($14.50 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20 million), and 4,428 ETH ($19.75 million).

That totals about 15,427 ETH, which sums to roughly $69 million at the prices reported. According to public trackers cited in the coverage, these were likely coordinated OTC trades designed to avoid moving the spot market.

TOM LEE IS BUYING EVEN MORE $ETH

Tom Lee’s Bitmine just bought another $69M of ETH from Galaxy Digital. They now hold $8.66 BILLION of ETH.$BMNR is bullish on $ETH. pic.twitter.com/t9BWh9btPR

— Arkham (@arkham) September 19, 2025

How Much Of Ethereum Does BitMine Hold

Reports have disclosed that BitMine now holds about 1.95 million ETH. That holding is valued at about $8.66 billion using the same pricing used in the coverage.

Analysts tracking corporate treasuries say that corporate and institutional ETH reserves together amount to a few percent of circulating supply, and BitMine is listed among the largest single holders.

The figures can look large when compared with total ETH supply, but the share depends on which supply measure is used — circulating, staked, or otherwise locked.

Market Mechanics Behind The Move

Buying large amounts on OTC desks is common for public companies and big players. It reduces slippage and keeps big orders off public order books.

The ETH here moved without obvious price spikes. Some transfers were visible on chain; the private terms of OTC trades usually remain confidential.

Based on reports citing blockchain trackers like Arkham, the on-chain flows matched the size and timing described.

Risk, Accounting And Strategy

Holding vast amounts of a volatile token carries real risks. A sharp fall in ETH would hit BitMine’s balance sheet. At the same time, steady accumulation signals a clear strategic bet on future appreciation.

Market observers compare this approach to other firms that hold crypto as part of their corporate treasury, and regulators and accountants will watch how such holdings are reported in quarterly filings.

Related Reading

Corporate Accumulation Goes Big

Some details remain unclear. Reports cite Arkham and Strategic Ether Reserve as the primary sources, but OTC trades do not reveal full pricing details and the exact terms are often private.

Because those settlements happen off-exchange, public records show transfers but not every pricing details. Large holders’ activity tends to attract extra attention when ETH moves sharply up or down.

Based on these numbers, the move is one more sign of large corporate accumulation of ETH.

Featured image from Unsplash, chart from TradingView