As Q4 2025 approaches, investor interest is heating up around Ethereum alternatives, especially Solana (SOL) and Aptos (APT). Both are expected to post moderate gains, supported by bullish technicals and renewed institutional interest in Layer-1 blockchain infrastructure. With the broader market showing signs of stability, traders are scanning top-tier protocols for midterm ROI opportunities before year-end rotations begin.

Solana, for instance, is projected to trade between $164.46 and $199.53 over the coming months. Forecasts suggest a possible 25.64% ROI by December 2025, which, while respectable, indicates a measured pace of growth.

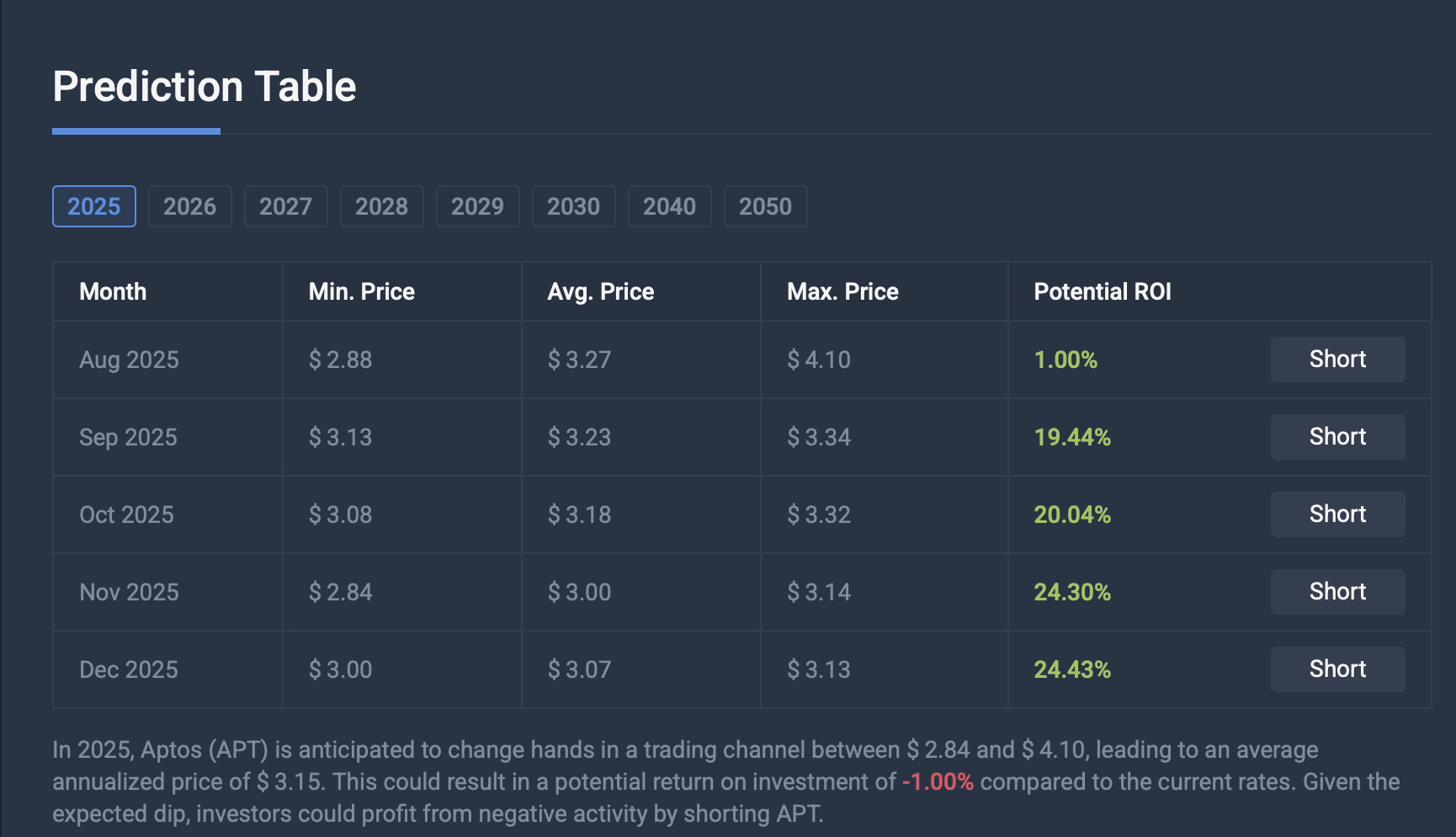

Aptos, meanwhile, may offer short-term volatility plays, with projected highs near $4.10 in Q4 – yielding a potential return just under 24.43%. These figures are drawing attention from mid-cap focused investors, particularly those rotating out of high-risk microcaps.

However, while these numbers hold promise, a growing segment of the market is beginning to seek asymmetric upside in lesser-known early-stage projects like MAGACOIN FINANCE.

Early-stage value meets high-growth potential

Amid the rise of Layer-1 leaders, MAGACOIN FINANCE has captured significant attention for a very different reason—its outsized potential for exponential growth. Recent analysis by crypto strategists projects that a $2,850 investment in MAGACOIN FINANCE could reasonably grow to around $119,700, reflecting a 42x multiplier that far exceeds traditional Layer-1 ROI ranges.

This breakout momentum isn’t based on speculation alone. The project has undergone fresh security audits, earning praise for its strong architecture and trustworthy presale framework. Unlike more mature assets like Aptos and Solana – where growth is tied to institutional narratives – MAGACOIN FINANCE is still early, which is where high returns often originate. Its community-first model and limited presale access are drawing in a wave of attention from informed retail investors who’ve seen similar stories play out with meme legends like SHIBA INU.

What to expect next for SOL and APT

Although Aptos and Solana both show signs of Q4 strength, their return profiles may remain capped by circulating supply dynamics and broader macro trends. Solana’s volume remains healthy, but short-term upside appears largely tied to broader DeFi traction. Aptos may offer scalping potential, especially if volatility spikes—but longer-term upside seems modest, given its shorting bias and fragmented use case adoption.

This leaves room for strategic investors to weigh where their capital could be better deployed. While Layer-1s like SOL and APT remain core assets in many portfolios, new capital is increasingly chasing earlier entry points in altcoins with higher ceiling potential.

Conclusion: Why the spotlight is shifting

As Layer-1 projects like Aptos and Solana head toward a solid but relatively linear Q4, MAGACOIN FINANCE offers a very different value proposition—an early-stage asset with security validation and a forecasted 42x upside. For forward-looking investors seeking more than just steady 20%–25% gains, the current momentum behind MAGACOIN FINANCE could mark the start of something far bigger.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.