Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price edged up a fraction of a percentage in the last 24 hours to trade at $117,217 as of 5:00 a.m. EST on a 42.97% increase in daily trading volume to $66.51 billion.

The rise in price comes right after the US Federal Reserve cut interest rates by 25 basis points on Sept. 17, 2025. Fed Chair Jerome Powell explained this decision by pointing to a slowing labor market, even though inflation remains high.

J-Powell and the Fed cut rates by 25 bps.

What does that mean for Bitcoin?

“It’s definitely bullish for Bitcoin” – @Andre_Dragosch from @Bitwise_Europe said on #CHAINREACTION.

3 main reasons:

💹 Decrease in real yield

💵 Inflation 🔼 = BTC upside

💰 Money supply growth = 🚀 pic.twitter.com/lKZmSSggUT— Gareth Jenkinson (@gazza_jenks) September 18, 2025

That shows a change in US economic policy aiming to help the economy grow. Powell mentioned slow job growth and unusual changes in labor supply as reasons to ease the strict monetary policy.

📝 Powell’s message yesterday was simple: the Fed cut because the labor market cracked.

🟡 Unemployment is rising and job creation is now below the breakeven rate

🟡 Inflation is back up and still “somewhat elevated”

🟡 Growth has slowed, activity is moderating

🟡 Tariffs are… pic.twitter.com/qECoEhawij— Er. Vipin (@Er_Vpin) September 18, 2025

The cut helps borrowers with high costs and makes many investors hopeful. This optimism spread across different investments, including Bitcoin and other cryptocurrencies.

The Fed’s rate cut aims to balance job growth and keep prices stable, which has been tough with mixed economic signals.

Lower rates usually mean more liquidity in the markets, which encourages people to invest in riskier assets like Bitcoin.

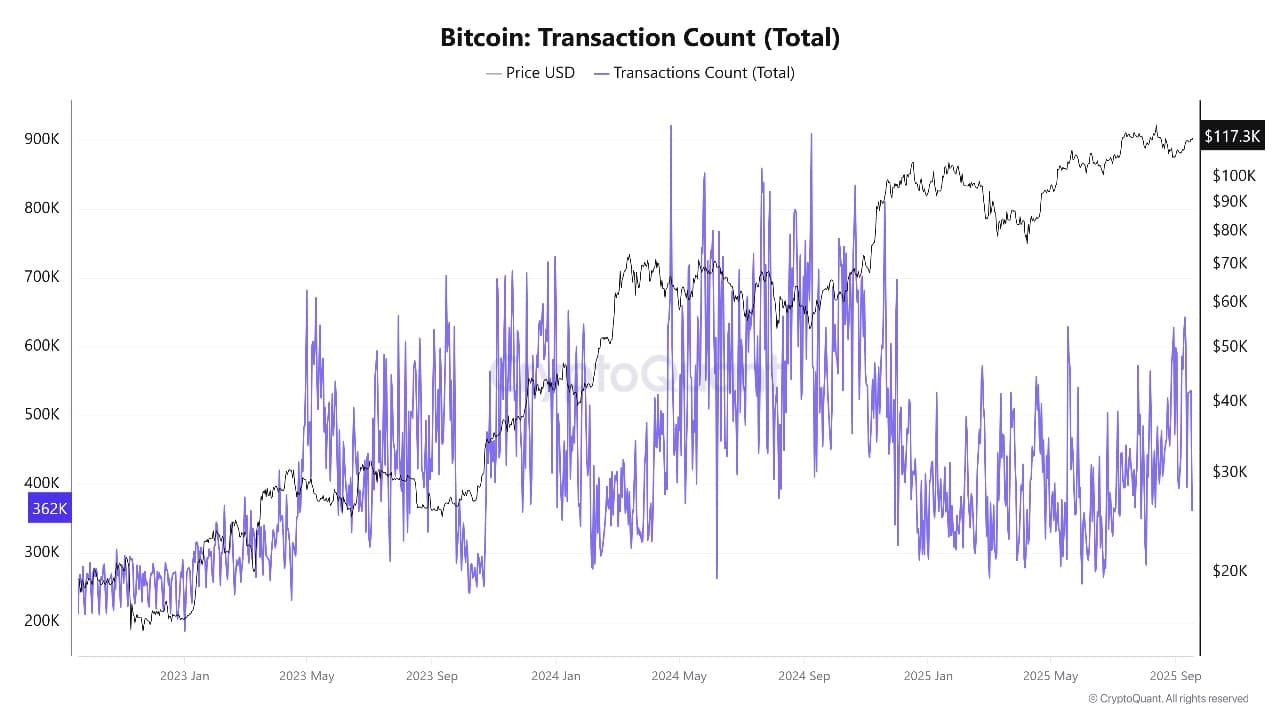

Bitcoin On-Chain Analysis Shows Growing Demand

Looking at Bitcoin’s on-chain data, there are signs of strong demand supporting the recent price rise. More Bitcoin transactions are happening, and more wallet addresses are active. This means more people are using Bitcoin.

Also, there is a noticeable trend of Bitcoin moving off exchanges, which means holders are keeping their coins rather than selling. This reduces the supply available for sale and helps the price go up.

Taking coins off exchanges is usually very bullish because it limits selling pressure and shows that holders expect the price to rise further.

The steady increase in transactions also points to a healthy network, giving extra confidence to traders during times of economic uncertainty.

Bitcoin Transaction Count Source: Crypto Quant

Bitcoin Price Technical Analysis Supports Further Upside

Bitcoin’s weekly chart shows that its price stays strong above $117,000, with a gain of about 1.69%. The price found support near the $110,000 and $105,000 levels, which have stopped it from falling during recent dips.

BTCUSD Analysis Source: Tradingview

The chart features Bitcoin trading well above its 50-week moving average around $98,000, a key level that shows the long-term uptrend is alive. The next resistance or target level is at $124,500, which could be reached as the price rides the current upward channel.

Technical indicators support the positive view: the Relative Strength Index (RSI) is about 60.7, suggesting the price is gaining strength but not yet too high. The Moving Average Convergence Divergence (MACD) has positive bars, confirming the bullish trend.

Meanwhile, the Average Directional Index (ADX) near 24.7 shows a fairly strong trend pushing the price upward. If Bitcoin stays above the $110,000 support, it could soon move past $124,500 and maybe even reach new record highs in the coming weeks.

In summary, Bitcoin is gaining from the Fed’s rate cut, which increases money flow in the market and makes investors more willing to take risks. On-chain signals show holders feel confident and are not selling, reducing market supply. Technical analysis also indicates Bitcoin is trending up with strong momentum.

The price moving past $117,000 is a big step, with solid support levels ready to keep it steady. When combining these factors, Fed policy, blockchain data, and technical trends, the outlook is favourable for Bitcoin to continue rising and test higher price levels soon.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage