Trump Media’s $2B bitcoin buy and $300M options plan could reshape Bitcoin market outlook. Explore price predictions, technical levels, and a short-term trade setup.

Trump Media and Technology Group (Nasdaq: DJT) has gone all in on digital assets, announcing in its Q2 2025 earnings report that it holds $2 billion in bitcoin and bitcoin-related securities.

The company also allocated $300 million to an options-based strategy targeting BTC, so it’s going to get even more crypto exposure.

This puts Trump Media in the top U.S.-listed companies with significant bitcoin reserves.

Total assets grew 800% year-over-year to $3.1 billion as the company built up its crypto treasury and raised institutional capital.

The Q2 release showed the company’s first positive operating cash flow of $2.3 million from its core media business, a sign of financial stability.

Trump Media’s hybrid crypto portfolio includes spot BTC and instruments like bitcoin ETFs and trusts. By holding these diversified assets, the company can maintain liquidity and capture long-term upside.

Market Impact and Expansion

The company’s CEO, Devin Nunes, said the liquidity from this will drive product expansion, including Truth+ streaming service, AI integrations, and a potential Truth Social utility token. Trump Media also hinted at launching crypto ETFs and managed products to tap into institutional demand.

Key points from Trump Media’s Q2 2025 strategy:

- $2B in bitcoin and related securities added to the treasury.

- $300M allocated to BTC options.

- Total assets are $3.1B.

- First positive operating cash flow.

- Truth+ streaming and AI features.

DJT closed at $16.92 on Friday, down 3.81% on the day and 50% year-to-date. Despite the stock volatility, the company’s deepening into crypto may impact market sentiment and institutional interest in bitcoin.

Bitcoin (BTC/USD) Technical Analysis and Trade

Bitcoin (BTC/USD) is at $113,985 after breaking below a symmetrical triangle. The 4-hour chart is bearish with three red candles in a row like the “Three Black Crows” pattern. The 50-period SMA at $116,852 is now resistance capping upside.

RSI is coming up from oversold (31.71) but still at 41.69 with no bullish divergence. Price is facing resistance at $114,939. If it fails to clear this level, it could retest $112,043 and then $110,065.

Trade Idea: Short if BTC is rejected between $114.9K-$115.5K with stop above $116.9K and targets $112K and $110K. Close above $117K invalidates this bearish view.

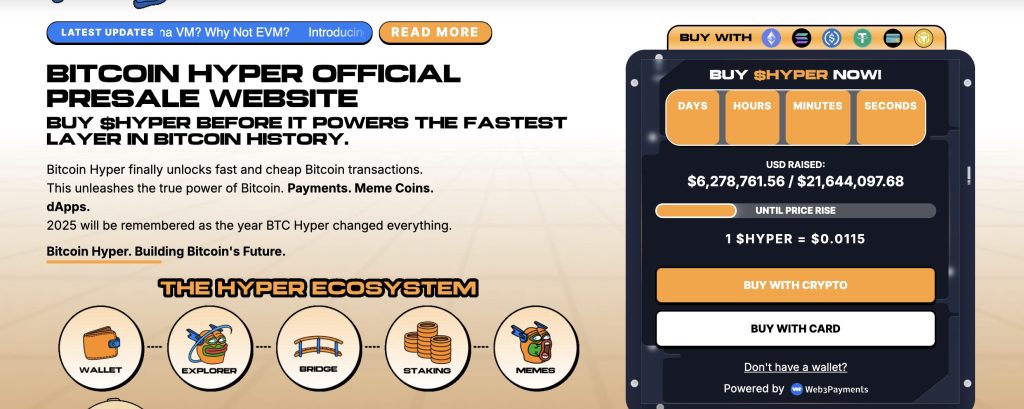

Bitcoin Hyper Presale Over $6.2M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first BTC-native Layer 2 powered by the Solana Virtual Machine (SVM), has raised over $6.2 million in its public presale, with $6,278,761 out of a $21,644,097 target. The token is priced at $0.0115, with the next price tier expected to be announced soon.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and a full rollout expected by Q1, $HYPER is gaining serious traction.

The post Bitcoin Price Prediction: How Trump Media’s Massive BTC Acquisition Could Reshape Market Outlook appeared first on Cryptonews.

Break above $117K = bull case reignites

Break above $117K = bull case reignites