Bitcoin (BTC) is set to close the week with solid gains after breaking above the $117,000 resistance — a move traders see as a bullish signal. The rally accelerated after U.S. President Donald Trump signed an executive order allowing cryptocurrencies, private equity, and real estate to be included in 401(k) retirement accounts.

Supporters call it a breakthrough for mainstream adoption, potentially opening crypto to millions of long-term investors.

Japan’s SBI Holdings also filed for a first-of-its-kind dual Bitcoin–XRP ETF. If approved, it would give investors exposure to both assets in one product — a development that could increase institutional participation in the crypto market. Together, these catalysts have strengthened sentiment, pushing BTC into a consolidation phase just under a key resistance level.

Bitcoin (BTC/USD) Technicals Signal Breakout Toward $131K

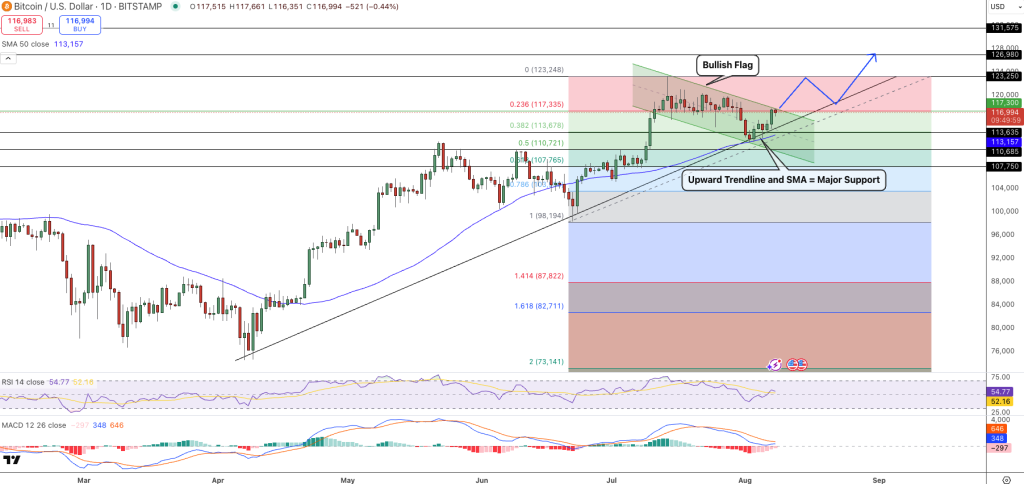

On the daily chart, Bitcoin is forming a textbook bullish flag beneath the $117,335 Fibonacci 0.236 retracement. This follows a sharp rally from the $98,000 area, anchored by a long-term ascending trendline and the 50-day SMA near $113,157 — a zone that has repeatedly triggered rebounds.

Momentum is shifting in favor of the bulls. The RSI has recovered to 54.77 from oversold conditions without entering overbought territory, and the MACD is flattening near the zero line, suggesting fading bearish pressure. A close above $117,335 today could see a retest of $123,250 with the flag’s measured move targeting $126,980-$131,575.

Key levels to watch:

- Support: $113,635-$113,157; $110,685

- Resistance: $117,335; $123,250; $131,575

- Breakout Target: Low $130Ks with potential to $150K longer term

If price dips, holding above $113,000 is key to the bullish setup. A break below $110,685 would delay the breakout.

Global Trends Add to Bullish Case

Beyond the charts, macro is looking good for Bitcoin. In the US, the Fed is expected to cut rates in September with 95% probability according to CME’s FedWatch Tool. Lower rates tend to boost demand for risk assets including crypto.

In Asia, China is pushing forward with stablecoin plans through Hong Kong to promote the Renminbi and reduce US dollar dependence in trade. This growing adoption of digital assets (even indirectly) supports Bitcoin’s long term demand story.

If the bullish flag pattern resolves as expected, current levels could be the last stop before BTC tests $131K in the coming weeks, setting the stage for renewed speculation about $150K and beyond.

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $7.7 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012575, but that price is set to rise in the next 3 days.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Traders Say “Fakeout” Is Bullish – New All-Time Highs Coming Soon appeared first on Cryptonews.