Join Our Telegram channel to stay up to date on breaking news coverage

Coinbase CEO Brian Armstrong says that the next major crypto bill, the Digital Asset Market Clarity Act of 2025, also called the CLARITY Act, is a “freight train leaving the station,” adding that this is the most bullish he has ever been on the bill.

In a video posted to X, the CEO said that there is a good chance that the bill will pass. This is after he attended discussions with lawmakers “on both sides of the aisle,” and added that the bill has bipartisan support.

“The Senate is strongly supportive of getting this done; the members I met with on both sides of the aisle are ready to get this legislation passed,” Armstrong said in the video.

Armstrong Says New Bill Will Ensure There Is Not Another Gary Gensler

The bill was introduced in May this year, and seeks to create a comprehensive market-structure framework for digital assets. It also draws a line between US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) roles in regulating the space.

Armstrong said in his video that draft texts are already being exchanged back and forth between lawmakers. Crypto industry executives have also been involved in the process to provide additional comment, the Coinbase CEO said.

In addition to Coinbase’s Armstrong, other crypto representatives that reportedly attended the discussions were executives from Ripple, Kraken, Circle, and Cardano.

Funny thing about “closed-door” sessions in DC… they somehow turned into meetings with House + Senate members on both sides last week. And then somehow public.

I was there the whole time promoting and educating, market structure, and why clarity matters for developers,… https://t.co/MrKNSylXKF

— Arjun Sethi (@arjunsethi) September 18, 2025

Representatives from tech-focused venture capital firms a16z, Multicoin Capital and Paradigm also reportedly joined the discussions.

Armstrong added that there was “a lot of alignment” between everyone that attended the discussions.

That’s after Senator Cynthia Lummis predicted earlier this month that the CLARITY Act would get to President Donald Trump’s desk to sign before the end of the year.

Armstrong wrote in his post that the bill will “ensure the crypto industry can be built here in America, driving innovation and protecting consumers, and making sure we never have another Gary Gensler trying to take your rights.”

Coinbase and several other US firms operating in the crypto space saw lawsuits initiated against them by the SEC under its former Chair Gary Gensler prior to the Trump Administration taking office.

The main argument for those lawsuits was that the companies were dealing with unregistered securities, while the Gensler-led SEC chose not to define whether some cryptos were indeed securities or if they were considered commodities. This classification will be one of the things that the CLARITY Act will try to establish.

Big Banks Still Trying To “Throw A Wrench Into Things”

Even though there was alignment during the discussions, Armstrong said that big banks are still trying “to throw a wrench into things.”

More specifically, they’re trying to ban rewards on stablecoins, he added. However, Armstrong doesn’t seem fazed by this, and said the members of the Senate that he spoke to “are not gonna let that happen,” adding they’re not going to bring up issues around stablecoin rewards again.

Armstrong went on to say that the regulation around stablecoin rewards was already “litigated and decided” on in the GENIUS Act, which was signed into law by President Trump in July this year.

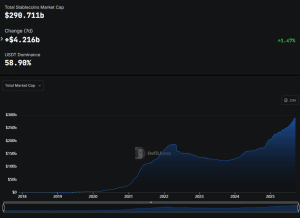

Its purpose is to create a comprehensive regulatory framework for payment stablecoins that are issued in the US by both domestic and foreign issuers. Since the Act was signed into law, it has led to accelerated growth for the stablecoin market.

Stablecoin market cap (Source: DefiLlama)

While the GENIUS Act prohibits issuers from directly paying yields or interest to token holders, banking groups have recently flagged a loophole in the Act that leaves room for exchanges or other intermediaries to offer rewards on behalf of issuers.

Banks have also warned that stablecoins pose a risk of deposit flight from the traditional financial system if that loophole is not addressed. They argued that customers may opt to move funds out of the banking system and deposit their capital into stablecoin platforms in an effort to chase higher yields.

Due to the fact that banks are subject to regulatory constraints, capital and liquidity requirements, deposit insurance, etc., the banks believe it’s unfair that non-banks like stablecoin issuers might mimic bank-like functions without the same level of oversight.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage