Ethereum Price Prediction models face tests as ETH hovers near key support. Spot ETF inflows have totaled $123.5 billion, driving ETH to reclaim $3,800, but tightening futures spreads and exchange reserves hitting nine-year lows raise the risk of a pullback to $3,000. Simultaneously, whale wallets are quietly rotating into Remittix (RTX), drawn by its real-world PayFi rails and aggressive incentives.

Ethereum’s Risk of Revisiting $3,000

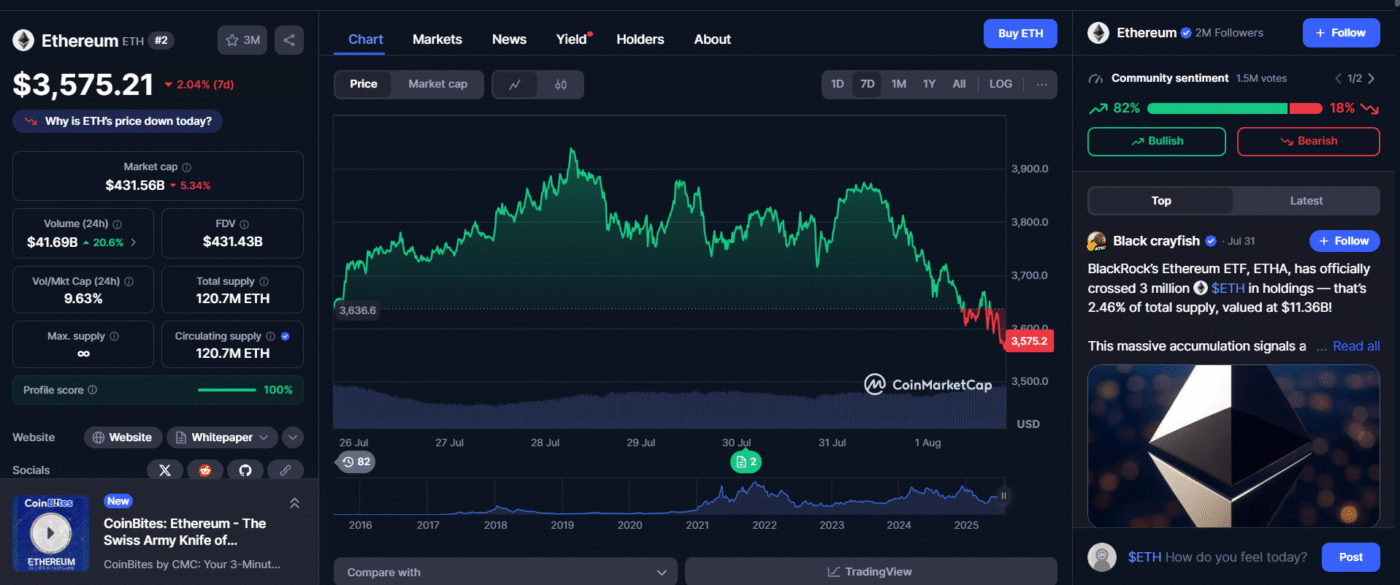

Ethereum Price Prediction charts show a descending wedge forming after ETH failed to break and hold $4,000 resistance twice in July. With daily exchange reserves down to the lowest level since 2016, traders debate whether the supply crunch can sustain a push higher or if profit-taking will drive ETH back to $3,200–$3,000 support.

Whale accumulation tells part of the story: anonymous addresses added 790,000 ETH—about $2.89 billion worth—over the past 20 days, suggesting some holders expect long-term upside. Yet futures open interest has flattened, and funding rates on perpetual contracts dipped into neutral, signaling indecision among derivatives traders.

Most Ethereum Price Prediction models mark $3,800 as a critical pivot: a sustained close below could open a path to $3,500, then to the psychological $3,000 floor. Conversely, reclaiming $4,000 on strong volume may validate longer-term bull cases, targeting $4,200 and $4,500 resistances next.

Remittix’s Utility Draws Whale Attention

As Ethereum Price Prediction scenarios grow murky, some whales are diversifying into Remittix (RTX), a $0.0895 token solving a $19 trillion payments problem through live pilots in Ghana and Kenya. A $250,000 community giveaway spiked wallet registrations by 420 percent, while CertiK audits have eased institutional concerns.

Here’s why Remittix is on whales’ radars:

- Direct crypto-to-bank transfers in 30+ countries

- Mass-market appeal beyond the crypto crowd

- Deflationary tokenomics designed for long-term growth

- Early believers are already calling it “XRP 2.0”

- Time-sensitive entry point before listings and parabolic growth

The upcoming Q3 2025 wallet beta—supporting 40+ assets with real-time FX conversion—adds a concrete milestone, giving RTX a clear runway that many speculative plays lack.

Hedging ETH Volatility with PayFi Rails

Ethereum Price Prediction remains a balancing act between ETF-driven inflows and potential profit-taking that could push ETH back toward $3,000. Traders locked into ETH’s narrative must weigh bullish fundamentals—like whale accumulation and regulatory clarity—against technical headwinds around $4,000 resistance.

Remittix offers a compelling hedge: live payment corridors, audited security, and a major $250,000 giveaway, plus an imminent Q3 2025 wallet beta launch. For portfolios bracing for an Ethereum Price Prediction flip from bullish to cautious, allocating a slice to RTX may provide stability and real-world utility alongside ETH’s market-leading upside.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.