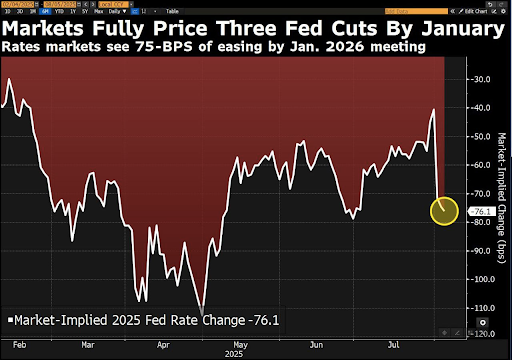

Markets price in 3 Fed cuts by January, fueling crypto liquidity hopes as traders eye Bitcoin and altseason momentum ahead.

Markets are bracing for a shift. Traders now expect the Federal Reserve to cut rates three times before January. That expectation has already been priced in across futures, prediction markets, and crypto sentiment.

Lower borrowing costs often drive liquidity into risk assets, and this time crypto is front and center. With capital rotation looming, Bitcoin and altcoins could be preparing for their next major move.

Three Cuts in Sight as Fed Pivot Locks In

The CME FedWatch Tool shows a 94% chance of a rate cut in September. Polymarket bettors place the odds at 85%. Both retail and institutional players appear convinced the easing cycle begins next month.

Wise Advice reported that markets have fully priced in cuts for September, October, and December. This path would drop the Fed funds rate by 100 basis points in seven months. Goldman Sachs has echoed this forecast, with a chance of an even steeper 50-basis-point cut if unemployment rises.

Liquidity and Crypto’s Risk-On Play

Lower rates tend to pull money out of cash and into higher-risk assets.

Cryptoinsightuk shared that reports pointed out that this shift has historically benefited crypto first. Liquidity usually moves from major tokens such as Bitcoin and Ethereum before spilling into smaller altcoins.

Interesting https://t.co/fBEhHPe1dD

— Cryptoinsightuk (@Cryptoinsightuk) August 5, 2025

Alva noted that past cycles saw a two-phase rally. First, Bitcoin and Ethereum recovered as traders repositioned. Then, capital flowed into DeFi, layer-2 networks, and niche narratives like AI and real-world assets.

Altseason May Follow the Fed’s Lead

The rate cut timeline now looks clear. September, October, and December meetings are shaping up as the turning point. That alignment with the crypto market’s hunger for liquidity could set the stage for a new altseason.

This rotation is not guaranteed, but traders are positioning for it. Cheaper capital historically fuels risk-taking, and crypto thrives in those conditions. With every expected cut, the case for a market-wide liquidity surge strengthens.

For now, all eyes remain on the Fed. The next decision may not just move interest rates. It could also decide how fast crypto’s next wave begins.